A new report by Climate Advisors, a consultancy specialising in climate and financial risk in the land sector, has shown that companies within the palm oil supply chain that commit to sustainable production have higher equity returns compared to their industrial counterparts.

RSPO members outperform non-members by 24.7 percentage points

Simulating the equity performance of companies from December 2012 to April 2019, the analysis shows that companies that comply with the RSPO Principles and Criteria exceeded a composite performance simulation of palm oil companies by 4.6 percentage points. When compared to non-RSPO member companies, RSPO certified companies outperform by a substantial 24.7 percentage points.

Matt Piotrowski, a senior analyst with Climate Advisors, said “Palm oil has been and will remain a volatile sector. For investors to reduce risk, they should be aware of externalities associated with deforestation and other sustainability challenges. It’s clear that when companies take measures to increase transparency and reduce exposure to deforestation-linked supply, they see stronger returns”.

“While the RSPO has received some criticism for not adopting stringent enough sustainability guidelines in certain areas, there has been substantive progress in the right direction, with many members adopting No Deforestation, No Peat, No Exploitation (NDPE) policies in order to align with the RSPO’s guidelines,” he added.

Read the full article, here.

Keep reading

RSPO Board of Governors Endorses Proposal to Form Executive Committee for Operational Oversight

Book Your Slot for the Additional prisma Clinic Session at RT2025

Advancing Jurisdictional Certification in Sabah: Strengthening Collaboration Between RSPO, UNDP, and Jurisdictional Approach System for Palm Oil (JASPO)

Call for Expression of Interest: Independent Investigation of a Complaint

Leading Labels: RSPO Among Top Sustainability Labels in Dutch Market

The 21st International Oil Palm Conference Successfully Took Place in Cartagena, Colombia

Top Performers of the 2025 Shared Responsibility Scorecard

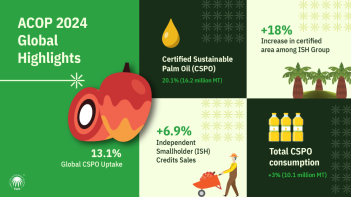

ACOP 2024: RSPO Market Trends Resilient Despite Global Challenges