Ongoing research by Climate Advisers and S-Network Global Indexes found that companies in the palm oil sector who do not have sustainability policies have significantly underperformed, compared to those that have followed no-deforestation programmes. Furthermore, the study found that companies who are members of the Roundtable on Sustainable Palm Oil (RSPO) outperform similar companies that are non-RSPO members. Over the past five years, RSPO companies outperformed the FTSE Bursa Malaysia Asian Palm Oil Plantation Index (USD) by approximately 6 percent.

Investing in deforestation poses material risks

The findings of the ongoing research also found that investing in companies engaged in deforestation-related activities poses material risks and produces poor returns for financial institutions. The study is being conducted by Matt Piotrowski and Gabriel Thoumi, with the results announced during the Global Climate Action Summit (GCAS) Affiliate Event in San Francisco on September 13.

RSPO commends Climate Advisers and S-Network for their effort in pursuing concrete evidence that can help to limit deforestation and enhance the sustainability of global palm oil.

For further information on the press release/research, please follow this link.

Keep reading

Book Your Slot for the Additional prisma Clinic Session at RT2025

Advancing Jurisdictional Certification in Sabah: Strengthening Collaboration Between RSPO, UNDP, and Jurisdictional Approach System for Palm Oil (JASPO)

Call for Expression of Interest: Independent Investigation of a Complaint

Leading Labels: RSPO Among Top Sustainability Labels in Dutch Market

The 21st International Oil Palm Conference Successfully Took Place in Cartagena, Colombia

Top Performers of the 2025 Shared Responsibility Scorecard

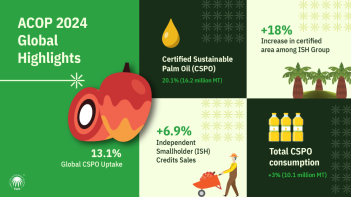

ACOP 2024: RSPO Market Trends Resilient Despite Global Challenges

RSPO: Actions for the Certification of Sustainable Palm Oil Production